7 Actionable Tips on How to Use Python to Become a Finance Guru

In today’s financial market, with all that is going on, you will agree with me that it is no longer enough to sit around being just an average player. In a need to be more; to be financial gurus, more and more people are choosing to employ python for finance and for financial analysis in such a competitive financial market.

How Python Is Used in the Finance Sector

Not everyone in the finance sector knows that financial python is actually a thing and can be employed in financial analysis so this information may be pretty new to you. And even if this information isn’t entirely new to you, you will still find them very useful. Let’s look at a few ways python can be used in the finance sector.

- Building a Trading Strategy

This usefulness of python is most common and beneficial to traders and financial services providers. That’s is individuals and companies who trade the financial market; buying and selling assets, stocks, bonds, and currencies as well as providing certain financial services. A trading strategy is a fixed set of rules or plans that help a trader make informed decisions on when to take a particular. When a trader follows a strategy he or she knows exactly when to go long (perform a buy order), go short (perform a sell order), or exit the market.

As a trader, you can build a strategy from the scratch using python and then use other python packages such as Quantopian, Zipline, NumPy, and SciPy to backtest your strategy and verify its effectiveness.

There are two simple and common strategies you can build using python. The first which is known as momentum strategy is also called trend trading or divergence. This strategy takes advantage of the belief that once price begins a movement in a certain direction it will continue its movement in that current direction and examples of this strategy include the moving average crossover, the dual moving average crossover, and the turtle trading.

A second strategy referred to as the reversion strategy or the cycle trading or convergence is formulated based on the belief that the movement of price will sooner or later reverse. Examples of this strategy include the mean reversion strategy and the pairs trading mean reversion strategy.

Both strategies make use of different tools and involve different kinds of code manipulations. And even though they work differently, they can be both correct. And best of all, they help a trader know exactly what he or she is doing.

- For Building Analytic Tools

Aside from helping companies develop a trading strategy, python for finance also makes it possible for companies to build complex predictive analytics that makes it possible to predict the direction of the market.

This is an aspect of algorithmic trading python which many are calling quantitative finance. It involves the calculations of sophisticated statistical and historical data and then creating a simple data visualization that helps to predict where the market is heading next.

This form of python financial analysis of large datasets is made possible with libraries such as Pandas, PyBrain, and Scikit.

- In Cryptocurrency

Companies that develop and sell cryptocurrencies usually combine python and finance when trying to create tools that will allow them to perform easy market analysis. This type of analysis usually helps equip the developers with market insights as well as predictions of what is to be expected.

This process of using python for stock technical analysis is especially useful for retrieving old and current cryptocurrency pricing and then using it to create a visualization of future prices. And Anaconda, a very common ecosystem in Python data science is what developers use in creating these cryptocurrency tools.

- For Developing Banking Software

Python and finance also become a very important combination when financial organizations are trying to build online banking platforms and payment solutions like the very popular ATM software.

Many of the online and mobile platforms used by many financial institutions are built from the scratch using python packages. Many of these platforms even become full-fledged social networks. One such platform is called Venmo which you may even be familiar with.

It is becoming more and more common for more financial organizations to engage python this way because using python is not only simple but also very flexible.

Examples of Python Usage in Financial Analysis

There are practical and real-life examples of how python can be used in financial analysis but for the sake of time and space, we will look at just two examples to help you see the need for mastering python for finance.

Example 1. Monte Carlo Valuation of European Call Option

First, list out the parameters and assign them values:

S0 = 100.

K = 105.

T = 1.0

r = 0.05

sigma = 0.2

Then run this with NumPy:

from NumPy import *

I = 100000

z = random.standard_normal(I)

ST = S0 * exp((r - 0.5 * sigma ** 2) * T + sigma * sqrt(T) * z)

hT = maximum(ST - K, 0)

C0 = exp(-r * T) * sum(hT) / I

And print out the result:

print "Value of the European Call Option %5.3f" % C0The result:

Value of the European Call Option 8.019Running the program above in an interactive environment such as IPython will look like something like this:

#

# Monte Carlo valuation of European call option

# in Black-Scholes-Merton model

# bsm_mcs_euro.py

#

import numpy as np

# Parameter Values

S0 = 100. # initial index level

K = 105. # strike price

T = 1.0 # time-to-maturity

r = 0.05 # riskless short rate

sigma = 0.2 # volatility

I = 100000 # number of simulations

# Valuation Algorithm

z = np.random.standard_normal(I) # pseudorandom numbers

ST = S0 * np.exp((r - 0.5 * sigma ** 2) * T + sigma * np.sqrt(T) * z)

# index values at maturity

hT = np.maximum(ST - K, 0) # inner values at maturity

C0 = np.exp(-r * T) * np.sum(hT) / I # Monte Carlo estimator

# Result Output

print "Value of the European Call Option %5.3f" % C0

Example 2. Google Stock Price

First, ensure you have all the libraries you need imported and ready to run:

In [1]: import numpy as np

import pandas as pd

import pandas.io.data as web

Next, download the Google Stock Price data from the web:

In [2]: goog = web.DataReader('GOOG', data_source='google',

start='3/14/2009', end='4/14/2014')

goog.tail()

The Output:

Out[2]: Open High Low Close Volume

Date

2014-04-08 542.60 555.00 541.61 554.90 3152406

2014-04-09 559.62 565.37 552.95 564.14 3324742

2014-04-10 565.00 565.00 539.90 540.95 4027743

2014-04-11 532.55 540.00 526.53 530.60 3916171

2014-04-14 538.25 544.10 529.56 532.52 2568020

5 rows × 5 columns

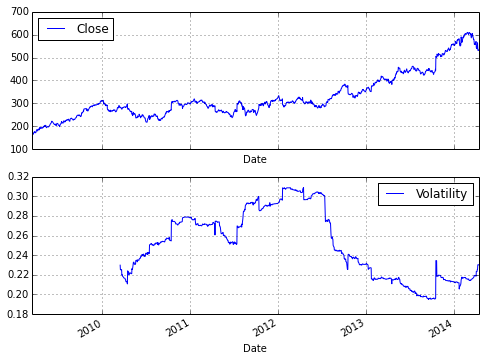

Then, run the analytics for the volatilities:

In [3]: goog['Log_Ret'] = np.log(goog['Close'] / goog['Close'].shift(1))

goog['Volatility'] = pd.rolling_std(goog['Log_Ret'],

window=252) * np.sqrt(252)

And, lastly use matplotlib to plot a line to give you a visualization of the data:

%matplotlib inline

goog[['Close', 'Volatility']].plot(subplots=True, color='blue',

figsize=(8, 6))

The Result:

Pros and Cons of Using Python in Finance

There are both pros and cons involved when using python for financial analysis and although the benefits of using python are conceptually endless, let’s consider about four of them.

Pros

- Simplicity and Flexibility

Using python in finance is considered very simple and flexible as writing and deploying software with python can be one of the easiest and fastest things to do.

With python, companies can develop products with considerable speed while keeping the risk of potential error very minimal

- Vast Collection of Libraries and Tools

Aside from being very easy and simple to use, python comes with a vast collection of tools and libraries which makes development and integrations with third parties very convenient for developers.

This makes it a lot easier for companies to build and release products for python stock technical analysis quickly as well as save a lot of money and time

- Popularity

Python is an open-source project that has a community of experts and tech enthusiasts constantly building, maintaining, contributing, and sharing knowledge.

These ensure that all developments with python only follow industry best practices. It also makes it impossible for you to ever get stranded while working on a project as there will always be a large pool of fine knowledge for you to draw from as well as a community of experts if you were to need their contributions.

- Creating Scalable Products

Organizations that employ python and its other frameworks in creating products will find it easy to scale up the products by simply tweaking the original code.

This makes it possible to always have a flawless product that is responsive to the new needs of the customers, offer extra services with personalized experiences.

Cons

- Speed Limitations

The lines in a python code are usually executed one after the other. This may translate into making a product built with python to run slower than normal and this usually becomes a problem when speed should be the main focus of such a product.

- Weak Mobile Computing

Ideally, python does not run in a mobile environment which means it can prove challenging to develop a python project that runs on both Android and IOS devices. However, this problem can be mitigated by using the numerous python libraries to develop products built especially for such devices.

- Threading Restrictions

Python does not generally support threading because of a mutex known as Global Interpreter Lock (GIL). Meaning only a single thread can be executed at a time. This may add to the speed limitation disadvantage but can be resolved when we use multi-processing programs rather than multi-thread applications.

Tips for Effective Python Usage in Finance

The following tips will ensure that you take full advantage of all that financial modelling in python entails.

- Always Use Libraries

Using the many python tools and libraries available at your disposal is one of the most effective ways to make sure you get the best out of this ecosystem of data science

- Be Open to Collaboration

Collaborating with others while using python is how you make sure you never get stuck on a project

- Build for The Customers

It is very easy to go off-track with product and project development because of the type of versatility that python allows you, yet ensuring that the products you build are tailored after what your customers need is how you truly get the best out of python for financial analysis

- Make it Open to Scalability

When developing with python it is advisable to allow room in the code for tweaking. This will allow you to scale the product when the time is right

- Be Aware of all The Pitfalls

Although this may prove challenging especially for a newbie or non-developer, knowing the pitfalls associated with python, especially those that may negatively affect your project is a very smart thing to do

- Carry Out Intensive Backtesting

Once a product built with python is complete it is always a good idea to carry out intensive backtesting to ensure that what you have developed will be both effective and useful

- Use Multiple Symbols

Combining and incorporating more than a single company of symbols while developing a product for financial analysis ensures you get a framework that is less risky to use with fewer lookahead bias.

Conclusion

The usefulness of finance python in today’s financial market cannot be overemphasized. The many application of python for finance can be as interesting as it can be a little confusing sometimes. However, you will agree that there is the need to truly understand python stock technical analysis to truly become a financial guru. To learn more and stay up to date with recent events and happenings in your favourite “Hello World” language, then subscribe to our email newsletter and always share with your friends on social media so they too are not left out.